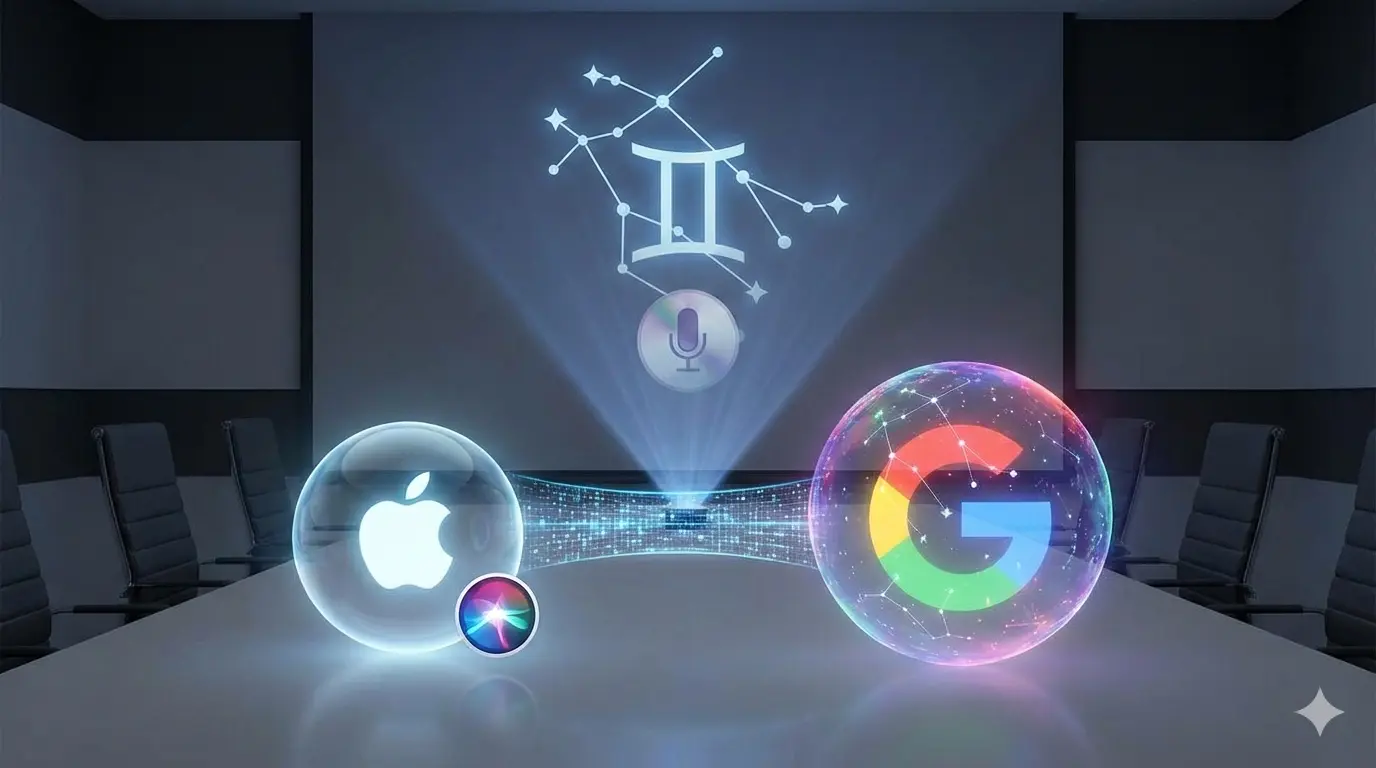

Apple–Google AI Deal: Why Gemini Is Taking Over Siri

Apple and Google have shaken up the tech world with a rare multi-year AI partnership that pulls Google’s Gemini straight into the core of Apple devices, giving Siri a long-overdue intelligence upgrade and quietly ending Apple’s dependence on OpenAI’s ChatGPT. The deal, worth around a billion dollars a year, arrives at a moment when Apple was clearly falling behind rivals in advanced reasoning and multi-step automation, and now Gemini will become the foundational engine powering iPhones, iPads, Macs and even Vision Pro. For Google, the win is huge: its AI instantly reaches more than two billion Apple users, pushing Alphabet’s value to record highs and raising fresh antitrust worries, especially after Elon Musk warned that Google’s control over search, Android, Chrome and now Apple-side AI is turning into an “unreasonable concentration of power.” Privacy debates, competitive tensions and the future of Siri all collide in this one deal, making it one of the most consequential AI moves we’ve seen in years.

A major shift in the global AI race unfolded this week as Apple and Google locked themselves into a multi-year partnership that pulls Google’s Gemini straight into the core of Apple devices. The move has already sparked industry reactions, including a pointed warning from Elon Musk, who labelled the arrangement an “unreasonable concentration of power.”

The deal, though long rumoured, still caught several analysts off-guard because Apple and Google have competed across almost every major tech segment for more than a decade.

A Quiet Rivalry Turns Into a Strategic Link

Apple has agreed to integrate Google’s Gemini models into Siri and other system-level functions, effectively making Gemini the foundational AI engine behind the next wave of iPhones, iPads, Macs, and even Vision Pro. Apple will still build its own interface on top, adding the privacy controls it always claims as its signature layer, but the core intelligence belongs to Google.

The numbers are large even by Silicon Valley standards. Apple is expected to pay roughly a billion dollars every year for access to Gemini, a figure that signals how urgent this upgrade had become.

Why Apple Needed This Deal

In recent years, Apple had started slipping behind its AI rivals. Gemini, OpenAI’s ChatGPT, Microsoft’s Copilot—everybody moved ahead while Siri remained stuck in its old template of single-command responses and limited reasoning. The company even pushed back major Siri upgrades to 2026, something that quietly acknowledged the gap.

Buyers have changed too. People are now choosing phones based on intelligence—context, automation, multi-step reasoning—not just camera lenses or screen brightness. Apple could not afford to let its flagship products feel outdated. The tech world still remembers how Nokia and BlackBerry collapsed when they missed a wave.

Apple’s insistence on building everything in-house also became a problem. Training a world-class LLM requires thousands of GPUs, billions of dollars, and enormous datasets. Reinventing the wheel was starting to look unrealistic, even for Apple.

What Google Gets in Return

For Google, the upside is huge. More than two billion Apple devices will now run Gemini in some capacity. That instantly places Google’s AI inside the daily flow of global consumers—their calls, schedules, queries, travel bookings, casual searches, everything.

Alphabet’s market value hit four trillion dollars for the first time right after the announcement, and the stock reached an all-time high in U.S. trading. Financially, the annual revenue is nice, but the strategic control is the real prize.

This deal also puts pressure on Google’s traditional rivals. Android, Chrome, search, and now system-level AI on Apple’s side—it’s a spread of influence regulators may not overlook.

OpenAI Loses Its Largest Hidden Partner

Before this deal, Siri leaned on ChatGPT whenever it failed to answer something. Apple was quietly dependent on OpenAI’s tech, but that setup now becomes secondary. Gemini will be the default brain, and ChatGPT—if present at all—sits in the optional layer.

For OpenAI, losing system-level access to the world’s most valuable consumer tech ecosystem is a direct hit. Had Apple partnered deeply with ChatGPT, it would have been their biggest win to date. The opposite happened.

There were trust issues too. OpenAI is heavily tied to Microsoft, and Apple was reportedly uncomfortable placing its intelligence stack inside a system influenced by a competitor. Privacy concerns played a role as well.

How Siri Will Transform

Siri’s redesign is expected to be substantial. Instead of performing small, isolated tasks, the assistant will now remember earlier prompts, interpret context, and execute multi-step requests. Booking routes, saving reminders, coordinating travel, managing paperwork—these tasks become chainable across apps without users breaking the flow.

This shift pushes Siri into a role closer to a proactive digital operator rather than a voice shortcut system. Apple has hinted at broader automation across its ecosystem once Gemini is fully embedded.

Privacy Questions That Won’t Go Away

Apple maintains that device-level privacy remains intact and that user data will not be shared with Google. Critics, though, point out that Gemini’s backend still belongs to Google. Whether any long-term metadata flows back into Google’s larger infrastructure remains a concern, and this debate is unlikely to fade.

Apple’s strongest brand advantage has always been its “your data stays with you” story. This partnership tests that claim in new ways.

The Antitrust Angle and Musk’s Objection

As soon as the partnership became public, Musk posted that the combination of Android, Chrome, and now Apple-side AI gives Google too much power. Regulators may take a similar view. Market concentration, limited choices, and higher entry barriers for smaller AI firms are already noted by policy groups.

Some observers believe Musk hoped Apple might consider using his own Grok AI, but that window appears closed.

The Larger Meaning of This Shift

The deal reflects a broader truth: AI is becoming basic infrastructure, much like electricity or semiconductors once did. Control over this infrastructure will define which companies and countries stay competitive. Hardware specs are no longer the main battlefield; intelligence and automation are.

People will soon judge a phone not by how it looks but by how smart it feels. Apple repositioned itself just in time, and Google embedded itself deeper than anyone expected.